CEO Net Present Value

byChicago & Washington DC

Egon Zehnder International, Inc.

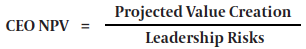

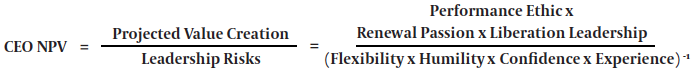

There are substantial parallels between examining a CEO candidate and calculating the NPV of a capital expenditure. Much like a capital equipment investment project, every CEO candidate carries a certain capacity to create value, as well as a bundle of execution risks that might impede actual value creation. Boards can calculate CEO NPV by gauging a CEO candidate’s projected value creation, discounted by his or her leadership risks:

So how does one define the numerator and denominator to calculate CEO NPV?

Projected value creation

Projected Value Creation depends largely on the CEOs capacity to create a performance culture that permeates the entire company. In a previous work, we examined how companies can create a true high-performance culture.3 Such companies consistently do three things:- Adhere to a performance ethic that combines the ambition to do the unthinkable and the discipline to deliver the nearly impossible

- Exercise a passion for renewal in the business, products, the organization and its people

- Liberate the right leaders to get on with the business of the company

- Are they fiercely ambitious and rigorously disciplined?

- Can they reinvent continually? Do they push the organization into new spaces by disrupting the organization and the industry?

- Can they “get out of the way” and let their teams create extraordinary outcomes?

Leadership risks

Conventional wisdom holds that the risk of a CEO appointment bears direct relation to the CEO’s experience base. For instance, CEOs making dramatic transitions across industries or cultures are intuitively presumed to be riskier choices. This way of thinking does carry a certain face validity. Boards have reason to favor candidates who are proven in situations analogous to those the company anticipates. Particular “formative” or “must-have” experiences such as managing a turnaround, launching a new market expansion, or shepherding a merger can yield knowledge and insights that can only be gained by having been there and done that.However, our work suggests that the risks and limitations of CEO appointment more closely correlate to how an executive processes experiences than on the experiences themselves. Humility and flexibility are especially crucial traits in a CEO.

Should anyone hesitate to appoint a CEO with aptitudes and strengths known to drive performance in practically any industry?

Leaders with a high degree of flexibility – ability to change – can make even sharp transitions with grace and aplomb. Flexibility can be considered “part 2” of humility, which allows the CEO to see that change is needed, while flexibility is the willingness to then make that change. If leaders have the right degree of flexibility, this can significantly broaden the impact of their experiences. Leveraging previous learning to do things differently means organizations are not exposed to the risk of redeployment of a previously unsuccessful (or even partly successful) approach. Viewed through this lens, Louis Gerstner’s NPV “discount rate” was fundamentally low, even though he repeatedly led companies in industries where he had little direct experience. Should anyone hesitate to appoint Louis Gerstner, a CEO with aptitudes and strengths known to drive performance in practically any industry? In sum, CEO NPV gauges candidates’ projected value creation in terms of their ability to create a performance culture, “discounted” by gaps in their personal humility, flexibility, and experience:

Certain of a candidate’s potential derailers can likely be mitigated, once they have been brought more fully into view. However, when the analysis reveals an inherent lack of mental flexibility and humility, the board should recognize that such deficits are not easily erased.

Recognizing that humility and flexibility are keys to reducing leadership risks can dramatically change the board’s view of CEO candidates who they previously saw as a “safe pair of hands.” In truth, a CEO candidate who has had a long career at a particular firm may actually be a risky choice if they do not also have the requisite humility and flexibility to shift their approach in the face of a disrupted environment.

Prudent audacity

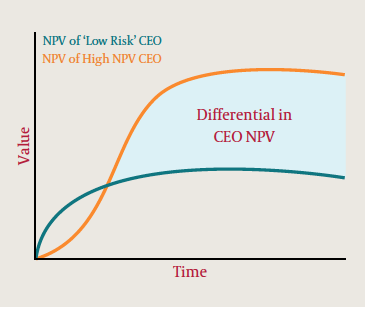

Should this calculation of CEO projected value be the sole basis for CEO selection? Hardly. But a rigorous analysis of each candidate’s projected value impact can counter the dangers of illusory safety by also allowing a measure of prudent audacity.To better understand how this CEO NPV methodology might work in the real world, consider the following scenario, illustrated in a graph contrasting the expected trajectories of two CEO candidates.

“Low Risk” CEO is a candidate with ambitions and experience that feel directly on point for the role. Accordingly, his discount rate is lower early on, leading to an initially higher present value. However, “Low Risk” CEO is not particularly agile-minded or open to learning from experience and has a background of solid but middling performance. This substantially limits his upside and elevates his discount rate over time, as the future is bound to bring unprecedented opportunities and challenges.

Raise the bar

A CEO is the most complex and consequential asset a company will finance. As such, it is understandable that boards instinctively strive to minimize risk. The NPV analysis described above will often reveal that an unconventional CEO candidate is actually the safe bet.Most importantly, CEO NPV helps boards raise the bar for CEO performance – and raising the bar is absolutely imperative. In a disrupted world, a new CEO may soon face radically different challenges than those faced by the incumbent. That means the “conservative” candidate may be the most risky choice.

No comments:

Post a Comment